WASHINGTON, D.C.—To reduce the potential risk of submitting improper claims for payment or other violations of Medicare regulations and laws, rheumatologists and healthcare providers who participate in Medicare and other federal health benefits programs should develop, implement, and adhere to a personalized effective compliance plan, a legal expert said during a session titled, “Top 10 Compliance Risks Facing Physicians” here at the 2012 ACR/ARHP Annual Meeting, held November 9–14 in Washington, D.C. [Editor’s Note: This session was recorded and is available via ACR SessionSelect at www.rheumatology.org.]

According to Robert W. Liles, Esq.—an attorney at Liles Parker PLLC in Washington, D.C. who specializes in medical compliance issues—the Secretary for the Department of Health and Human Services (HHS) may require all participating providers to have a comprehensive compliance plan under the Patient Protection and Affordable Care Act. Although Liles said no mandatory date has been set for rheumatologists to comply with this requirement, he expects the date to be announced sooner rather than later.

“Rheumatologists are under the radar,” Liles told a roomful of specialists at the annual meeting. “Like oncologists, they often dispense extraordinarily costly drugs, such as the biologics infused to patients suffering from chronic disease,” he added. “In light of the multiple layers of private Medicare and Medicaid contractors currently engaged by the government to ferret out alleged overpayments and fraud, everyone in this room will likely be audited at some point in the future,” he emphasized.

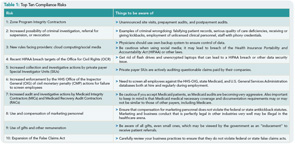

To help educate rheumatologists on some of the compliance risks they currently face or may face in the near future, Liles discussed the top 10 risks to physicians in private practice (see Table 1, below) and 10 easy steps that physicians can implement to reduce their risk of noncompliance with the law (see “Ten Easy Steps to Improve Your Compliance,” p. 32).

Among these, Liles talked about a type of Medicare contractor that focuses almost entirely on nonhospital providers, including rheumatologists in private practice. Called Zone Program Integrity Contractors (ZPICs), they are “knowledgeable of the ‘ins and outs’ of Medicare’s most complex billing practices, and are adept at using sophisticated data mining techniques to identify and target physicians and other providers who appear to be outliers when compared to their peers,” Liles said.